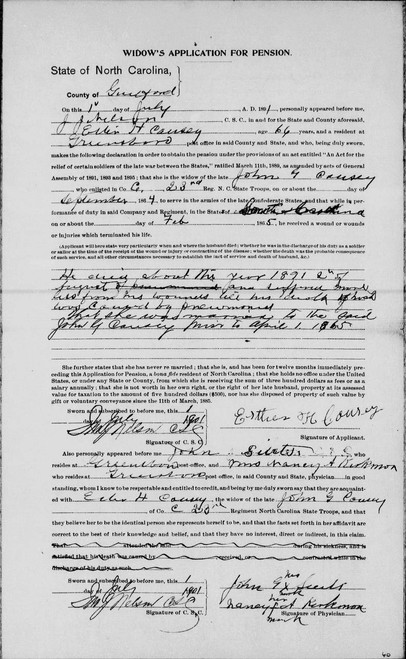

The State Auditor, Pension Bureau, Acts of 1885 and 1901 Confederate Pension Applications include the following: name; age (at time of application); place of residence; service information such as company, regiment, length of service, and wounds or disability; name of witness; and date of application. The files sometimes include correspondence or additional affidavits regarding a soldier's or widow's claim. Also verification from the county pension board regarding applicant's claim and whether the application was approved or disallowed by the state-level board of inquiry. The widows' applications are usually filed under the names of the deceased soldiers, but it can be helpful to provide the name of the soldier's wife or widow to aid our search.

The 1885 and 1901 Pension Applications are available in the Digital Collection. For additional information about the Pension Bureau and related records, please see description of the State Auditor's records in the online catalog.

The first general (or expanded) pension law in the state for Confederate veterans and widows was passed in 1885 (P.L. 1885, c. 214). This law provided for payment of $30 annually to Confederate veterans who were residents of the state and who had lost a leg, eye, or arm, or who were unable to work because of disability. Widows of slain soldiers were entitled to the same benefits as long as they did not remarry. Applicants owning more than $500 worth of property or earning a public salary of $300 were ruled ineligible for a pension.

Applications had to be certified, witnessed, and filed with the county commissioners who in turn sent them to the state auditor. The total pension expenditure was not to exceed $30,000 per year. If there were more than 1,000 pensioners, each would get a pro rota share.

Before the passage of this general pension law of 1885, several resolutions and laws had been passed to provide compensation to maimed or totally blind veterans. The first law was passed in 1866 by the General Assembly which provided veterans with artificial limbs or commutation money ($50) for those veterans who had procured limbs at their own expense or had useless limbs. A resolution was also passed permitting counties to levy a tax for the relief of disabled, destitute veterans. Veterans eligible to receive this assistance had to submit certificates of their disability. For these earliest certificates, see the series: Act of 1866 (and 1879) Pension Certificates.

The 1885 law was amended by P.L. 1887, c. 116, to include widows of soldiers who had died of disease while in service. The next general pension law was passed in 1889. This law, when amended in 1901, greatly expanded the eligibility requirements for pensions and stipulated that all persons meeting those requirements (current pensioners included) had to submit a new application.

In 1901, the General Assembly passed a new pension law (P.L. 1901, c. 332) entitled "An Act to amend Chapter 198 of the Laws of 1889, for the relief of certain Confederate soldiers and widows." Under this new act "every Person who has been for twelve months immediately Preceding his or her application for a pension a 'bona fide' resident of the State, and who is incapacitated for manual labor and was a soldier or a sailor in the service of the State of North Carolina or of the Confederate States of America, during the war between the States, and to the widow remaining unmarried of any deceased officer, soldier or sailor who was in the service of the State of North Carolina or of the Confederate States of America during the war between the States (Provided said widow was married to said soldier or sailor before the first day April 1865)" was entitled to a pension.

As first begun in 1889, those applicants eligible for pensions were divided into four classes based on disability: first class pensioners were totally disabled ($72 annually); second class pensioners had lost a leg or arm ($60); third class pensioners had lost a hand or foot ($48); and fourth class pensioners had lost an eye, or were partially incapacitated due to other wounds ($30). Widows were classified as fourth class pensioners.

All persons entitled to pensions under the act, whether previously drawing pensions or not, were to appear before their county Board of Pensions on or before the first Monday in July 1901 for examination and classification. For pension applications before 1901, see the series, Pension Bureau: Act of 1885 Pension Applications. Applications for admission to the Soldiers' Home, however, are included with applications under the 1901 act, even though some may date from before 1901.

Certain persons were excluded from benefits under the pension acts. Applicants owning more than $500 worth of property or earning a public salary of $300 or more were ruled ineligible for a pension, and no one receiving aid under laws for relief of the totally blind or maimed was eligible. Inmates of the Soldiers' Home, recipients of pensions from other states, and deserters were also excluded from benefits under the pension acts.

Almost every succeeding General Assembly made some change in the pension laws. The amount received was lowered and raised, the property disqualification was raised to $2,000, and the date of marriage to make a widow eligible was moved forward several times until a widow was eligible if she had been married to a Confederate veteran for ten years before his death if his death occurred after 1899. Widows could remarry and still be eligible provided they were widowed again at the time the application was made.

In 1927, pensioners were reclassified, and a special category for Class "B" pensioners was established to compensate former slaves who could prove they had been servants of soldiers, or who could prove they had served in some support capacity.

In 1958 and 1959 there were some major changes in eligibility. Prior to 1958, federal law did not provide military service-based pensions for Confederate veterans or their widows. The federal law was changed in 1958 and any surviving Confederate veterans (North Carolina had none) or widows (or children of veterans IF orphaned, helpless, AND underage) became eligible for pensions through the Federal Veterans Administration. However, North Carolina's laws did not allow "double dipping" -- veterans or their widows could not receive pensions from another state or the federal government -- a situation which was corrected in 1959 to allow for receiving a pension from North Carolina as well as from any other state or the federal government. [However, children of veterans would continue to be ineligible for a state pension.] Many of the local Veterans Service Officers worked in cooperation with the State Auditor's Office to enroll all known surviving widows in both the state's pension system and the federal Veterans Administration pension system. For information on federal pension applications, researchers should contact their local Veterans Service Officer.

Many of the more recent pension files include copies of marriage and death certificates or affidavits concerning marriages and death information, in addition to providing service information. The marriage certificates were required as proof that the widow had been married to the veteran for ten years (later reduced to five years). Those widows married less than the designated time frame were ineligible for a pension unless they could prove a child was born of the union.